Sir Keir Starmer’s Labour Party has won a landslide parliamentary majority of about 170 seats in the UK general election, ending 14 years of Conservative rule and marking the worst political defeat in the Tories’ history. The seismic shift in the political landscape has been met by a muted reaction in the financial markets, with the outcome already priced in. FTSE 100 futures climbed, while the pound was slightly up against dollar.

As of 9am, Labour had won 411 out of 650 parliamentary seats in the House of Commons, securing a Labour majority just short of Tony Blair’s historic 1997 win. The Conservatives have so far won just 119 seats. On a night of high drama, former prime minister Liz Truss and 11 Tory cabinet ministers lost their seats, including Grant Shapps, Jacob Rees-Mogg and Penny Mordaunt. Sunak won his seat comfortably, while Jeremy Hunt and James Cleverly – likely new Tory leadership contenders – both clung on with wafer-thin majorities.

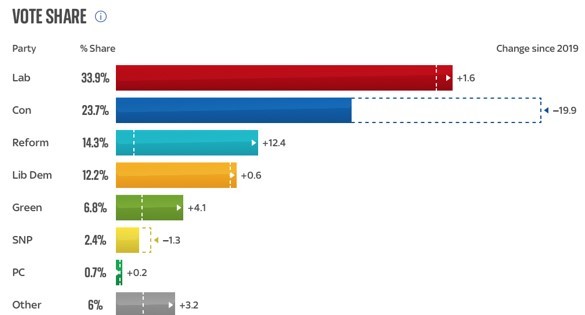

Beneath the surface of this immense Labour win is the role of Nigel Farage’s Reform UK, which appears central to the Tory collapse, coming second place in 89 seats nationwide. Reform won 4 seats – from 14% of the vote share – including a seat in the House of Commons for Farage at his eighth attempt. By contrast, Liberal Democrats won 71 seats, despite little change in their vote share compared to the previous election, at 12%, notably lower than Reform UK. The Greens won 4 seats. The Scottish National Party (SNP) suffered a similar wipe-out in Scotland, with Labour ending its 17 years in power and seemingly ending the independence ambition for at least the remainder of this decade and possibly longer. In Westminster, the SNP won just 9 seats and, so far, just 7 in Holyrood.

Turnout for the election has dropped to a 100-year low, indicating possibly apathy for the political status quo, or reflecting the summertime date which conflicted with family holidays. Labour’s share of the vote is around 34%, less than the 40% secured by former leader Jeremy Corbyn in losing the 2017 election, while the Tories’ share dropped by 20 points to around 24%, indicating the result reflects a rejection of the Conservatives rather than renewed enthusiasm for Labour.

Source: Sky News

Source: Sky News

Market reaction

Sir Keir Starmer is set to become the first Labour UK prime minister since May 2010 later this morning on a manifesto that promises economic stability, tough spending rules, planning reform, green energy transition and efforts to stimulate economic growth.

Investors widely predicted a new Labour government, and have responded with expected calm. The size of Labour’s majority could help provide stability to support the UK economy, at a time when political uncertainty continues across other major developed economies, notably the US and France, which may present the UK economy as a relatively ‘political safe haven’ for overseas investors. “Investors can cross ‘UK political risk’ off their list of worries for the time being,” says Chris Beauchamp, Chief Market Analyst at IG, London.

Capital Economics said the size of Labour’s majority has the potential to generate some upside in its forecasts for GDP, inflation and interest rates. “The economy won’t be vastly different under Labour as the fiscal constraints are the same,” explains Paul Dales, Chief UK Economics at Capital Economics. “Labour has pledged to follow very similar fiscal rules to the Conservatives. And the combination of low economic growth and high interest rates means that fiscal policy needs to be tightened broadly in line with existing plans to meet those rules. In other words, Labour can’t significantly loosen fiscal policy without breaking the rules and/or being held to account by a rise in gilt yields.”

Fiscal policy may be a bit more growth-friendly, as Labour’s manifesto suggests higher public spending than current plans and taxes, which could translate into a GDP bump, added Dales. Incoming Labour Chancellor of the Exchequer Rachel Reeves will inherit an economy where inflation has just fallen back to the 2% target and the Bank of England (BoE) is on the cusp of cutting interest rates, possibly as early as August. Inflation is forecast to continue to fall back a bit further, while the BoE will cut rates to as low as 3% by next year, helping to stimulate GDP growth to 1.2% this year, and 1.5% in both 2025 and 2026, according to Capital Economics. Reeves has downplayed the prospects for an immediate post-election fiscal event.

“A watchword of the incoming government is ‘stability’ both in terms of politics and policymaking,” says Cathal Kennedy, Senior UK Economist at RBC Capital Markets, London. “That extends to the Bank of England, where the manifesto commits Labour to preserving the BoE’s independence and 2% inflation target.”

Markets will be watching with interest to see if there are Labour policies which have an impact on UK PLC beyond what has been published in its manifesto.

If you would like to talk about how your company may be affected by the new government and its policy focus, do not hesitate to get in touch with our team today. We are well-placed to provide independent advice, including deal advisory, restructuring, capital management, performance improvement, transaction services and forensic services. Take a moment to refresh your understanding of the scope of the advisory services we can offer to help your business grow, recover and excel.

Daily News Round Up

Sign up to our daily news round up and get trending industry news delivered straight to your inbox

This site uses cookies to monitor site performance and provide a mode responsive and personalised experience. You must agree to our use of certain cookies. For more information on how we use and manage cookies, please read our Privacy Policy.