Bitcoin’s ascent to a fresh all-time high (ATH) to a whisker under $100,000 in November was fuelled by optimism surrounding President-elect Donald Trump’s return to the White House, along with the Republican’s sweep of majorities in the Senate and House of Representatives. The incoming unified Republican government is widely expected to adopt a pro-crypto stance, supporting a favourable market outlook and an easy confirmation process for Trump’s appointees in key regulatory roles.

Bitcoin had previously set an ATH in March, just below $74,000, but then entered a prolonged six-month holding pattern. During this time, market signals provided fodder for both bulls, who anticipated a consolidation before a breakout, and bears, who saw signs of distribution ahead of a breakdown. This period of conflicting technical signals reinforced existing biases, leaving neutral observers guessing.

The US election served as the volatility catalyst for bitcoin’s next major move. After testing range highs near $73,650 in late October, bitcoin broke out of its downward channel on election day and surged 47%, from $66,800 to just under $100,000 by November 22. This $33,000 move in just over two weeks coincided with a $1tn increase across the total crypto market, pushing the total value of the industry to $3.36tn and surpassing the previous ATH of $3tn three years earlier.

The election outcome is arguably the most bullish near-term scenario for bitcoin and cryptocurrency. While the probability of a unified Republican government increased as polling day approached, mixed signals from pollsters, betting markets and Wall Street left the outcome uncertain, with a divided or contested government also on the table. However, bitcoin’s recent price action prices in a near-perfect regulatory environment, but these gains can quickly unwind if these lofty expectations are not realised.

Market participants also cite previous regulatory setbacks as a driver for the current optimism. “Bitcoin is at the price it should have been in January 2022,” Anthony Scaramucci, founder of SkyBridge Capital, told Bloomberg. He claimed that outgoing SEC Chair Gary Gensler’s “arbitrary and capricious” decision to initially block a bitcoin ETF approval held back bitcoin’s growth.

Trump’s return to the White House

Donald Trump’s return to the White House comes with bold promises for the cryptocurrency industry. On the campaign trail, he pledged to make the US a “Bitcoin superpower” and the “crypto capital of the planet.” Speaking at a Bitcoin conference in Nashville in July, Trump announced plans to create a bitcoin “strategic reserve” using the government’s existing holdings of 208,000 BTC, worth approximately $20.4bn, most of which were seized from criminal activity. Reports suggest the government may look to acquire an additional 200,000 BTC annually over five years, potentially holding one million bitcoin, representing around 5% of the total supply. This reserve could hedge against inflation and serve as a tool for repaying the $36tn US national debt by periodically selling bitcoin for dollars. However, critics question the sustainability of such a policy, citing bitcoin’s volatility and the feasibility of implementing a reserve of this scale. For now, the narrative alone is helping spur the current rally, as investors bet on a crypto-friendly political and regulatory environment.

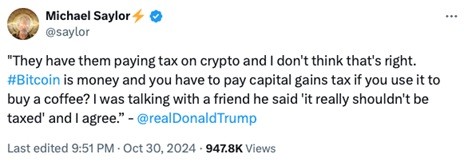

Trump’s second administration is also reportedly considering eliminating capital gains taxes on US-issued cryptocurrencies, which could transform the country into a tax-free crypto haven and accelerate investment flows into digital assets.

Trump has also floated the creation of a new White House position, a “crypto czar”, to lead the administration’s cryptocurrency advisory council. This council would coordinate with Congress and agencies like the SEC, Commodity Futures Trading Commission (CFTC), and the Treasury on crypto policy and legislation. “We will have regulations, but from now on the rules will be written by people who love your industry, not hate your industry,” Trump promised back in July. Speculation is already swirling around potential appointees. Coinbase CEO Brian Armstrong has been tipped as a candidate for the crypto czar role, while Armstrong has reportedly recommended Hester Peirce, a long-time crypto advocate, as the next SEC Chair. Trump has pledged to replace Gary Gensler, who will step down on inauguration day, signalling a significant departure from the SEC’s current enforcement-heavy approach.

Trump’s bitcoin embrace marks a clear U-turn from his earlier position. Five years ago, he dismissed bitcoin value as “based on thin air”.

His shift can be attributed to overlapping political and economic interests. Politically, Trump broadened his appeal among a growing crypto electorate, particularly younger, tech-savvy voters. Economically, the move aligns with his business interests by positioning the Trump brand with the growing digital assets sector. Reports suggest his media company, Trump Media and Technology Group (TMTG), is in advanced talks to acquire Bakkt, a cryptocurrency trading platform, while a new crypto venture, World Liberty Financial, has been launched by Trump’s long-time business associates.

During the final stages of Trump’s re-election campaign, Elon Musk proposed the federal government needed a department to overhaul government inefficiency and foster a more business-like approach to governance. Musk was subsequently appointed to co-lead the Department of Government (DOGE), the acronym a playful nod to the cryptocurrency that the Tesla CEO supports. Dogecoin’s market capitalisation surged following the announcement, with investors anticipating favourable developments. However, critics caution Musk’s unconventional approach may introduce volatility into an already unpredictable market.

Looming changing of the guard at SEC

The departure of Gary Gensler as SEC Chair on 20 January – inauguration day – could mark a transformative shift in the agency’s approach to regulating cryptocurrency. Under Gensler, the SEC pursued an enforcement-heavy strategy, often bypassing Congress rather than issuing clear, crypto-specific guidelines. His approach drew significant criticism from industry participants and policymakers, while he maintained aggressive enforcement was necessary to curb fraud and manipulation in a nascent, volatile industry.

Gensler presided over a lengthy list of failed SEC enforcement actions, notably including a US Court of Appeals ruling in August 2023 that the SEC’s permission denial for Grayscale Investments to launch a spot Bitcoin ETF was unreasonable. This landmark ruling cleared the path for the approval of 11 spot Bitcoin ETFs, fuelling a significant price surge from $26,000 to current levels near $100,000. Critics argue that the SEC’s refusal to provide crypto-specific guidelines left market participants stranded in a regulatory void that has stifled innovation and suppressed market growth.

In November, attorneys general from 18 states, including Kentucky, Florida, and Texas, sued the SEC, accusing it of “unconstitutional overreach” and interfering with states’ rights to regulate their economies. According to the filing, the SEC’s “sweeping jurisdiction without congressional authorisation” undermines basic principles of federalism and harms the very citizens it claims to protect by attempting to force digital assets into unsuitable securities frameworks.

The crypto industry broadly views Gensler’s departure as an opportunity for a more collaborative and tailored regulatory framework under new leadership. Potential successors include Paul Atkins and Brian Brooks, both crypto advocates. Atkins, who chaired the SEC under the Bush administration from 2002 to 2008, is known for a more hands-off regulatory philosophy. Brooks has held multiple roles in the crypto sector, including chief legal officer at Coinbase and acting Comptroller of the Currency under Trump in 2020. Whoever Trump nominates must secure Senate approval, but this is likely a formality given the Republican majority. The bigger challenge will lie in balancing crypto-friendly policies that support a growing economic industry with protecting investors and maintaining market integrity.

MicroStrategy’s Aggressive Bitcoin Strategy

MicroStrategy has cemented its position as the largest corporate holder of bitcoin through an aggressive acquisition strategy funded by convertible debt issuance. As of November 25, the company holds 386,700 BTC, valued at $37.1bn, with an average purchase price of $56,761 per bitcoin. MicroStrategy’s approach provides investors with a leveraged proxy for bitcoin exposure and has influenced traditional mining companies, such as MARA, to explore similar strategies. However, its long-term sustainability depends on favourable market conditions and access to continuous capital inflows.

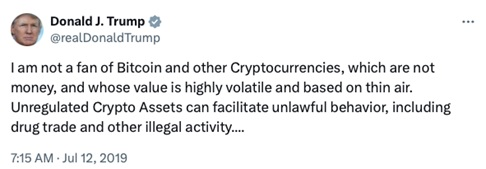

The strategy hinges on issuing convertible debt to fund bitcoin purchases. While this increases the number of outstanding shares – diluting existing shareholders – MicroStrategy has successfully grown its bitcoin holdings faster than its share count. For example, in the first nine months of 2024, the company’s bitcoin holdings increased by 33.3% to 252,220 BTC, while the share count rose by only 13.2%. This dynamic, marketed as “intelligent leverage,” effectively boosts the value of each share by accumulating bitcoin faster than dilution occurs. However, this model depends heavily on a rising bitcoin price and continuous access to funding.

Source: MicroStrategy

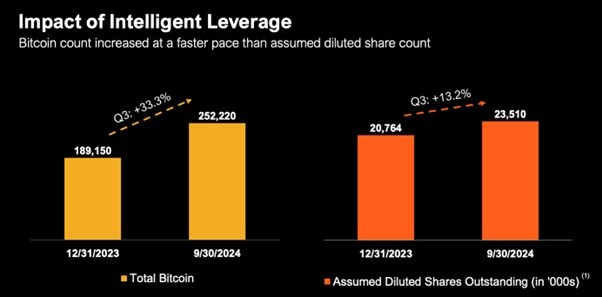

To sustain this growth, MicroStrategy operates a perpetual funding model, issuing new equity and debt to acquire additional bitcoin. While this benefits existing shareholders by increasing bitcoin holdings per share, new investors bear the dilution cost. In its Q3 earnings report, the company announced plans to raise $42bn over the next three years – $21bn in equity and $21bn in fixed-income securities. For this strategy to remain effective, each successive funding round must exceed the previous one and is exposed to financial risk if market conditions tighten or the bitcoin price declines.

Source: MicroStrategy

This reliance on external factors introduces significant risks. A sharp drop in bitcoin’s price could erode the value of MicroStrategy’s holdings, undermining its balance sheet and investor confidence. Similarly, tightening credit markets or declining demand for its debt and equity offerings could disrupt its ability to fund future purchases. These challenges are compounded by bitcoin’s inherent volatility, which affects both the company’s asset base and its ability to access favourable financing terms.

Critics argue that MicroStrategy’s model is a speculative bet on sustained optimal market conditions, diverging from traditional definitions of leverage that amplify investment returns. Instead, its approach relies on financial engineering: using convertible debt to accumulate bitcoin in a way that mathematically increases per-share asset value. While effective during bull markets, the strategy’s long-term viability is uncertain without continuous capital inflows and rising bitcoin prices.

MicroStrategy’s success has inspired other companies to consider adding bitcoin to their balance sheets. For example, shareholders of Microsoft have proposed a vote on 10 December to assess whether the company should invest in bitcoin, an SEC filing shows.

While the proposal, promoted by conservative think tank National Center for Public Policy Research, has drawn attention, Microsoft’s board recommends rejecting it, citing concerns over bitcoin’s volatility and liquidity risks during market downturns. Nevertheless, MicroStrategy founder Michael Saylor is expected to present his case to Microsoft’s board in a three-minute address, underscoring how his bitcoin strategy has captured industry attention despite its risks.

Price Outlook

Bitcoin’s price near $100,000 represents a remarkable 6.5-fold recovery from its $15,500 low following the FTX collapse two years ago. This phase of price discovery often brings heightened volatility, as further speculative bets and profit-taking test market stability.

The crypto industry remains a hub for large, cross-collateralised leveraged positions, which create systemic risks across cryptocurrencies, platforms, companies, and hedge funds. During speculative rallies, the allure of easy profits combined with widespread leverage heightens market stability risk. Fraudulent activities, including scams, often increase. In November, social media personality Logan Paul was reportedly facing questions over whether he profited in his cryptocurrency dealings from misleading fans. Similar concerns have been raised over Andrew Tate. Current market dynamics exploit investor naivety that amplifies market instability and can lead to sharp corrections if confidence falters or cross-collateralised bets needs to be unwound.

While bitcoin’s long-term outlook remains positive, investors must navigate the risks inherent in crypto speculative surges. The possibility of unfavourable regulatory changes, liquidity pressures in capital markets, and macroeconomic shifts – such as rising interest rates or economic slowdowns – cannot be overlooked. These factors can quickly dampen sentiment and disrupt the speculative momentum that is currently driving bitcoin’s price higher.

As the crypto sector matures, companies considering adding bitcoin or other cryptocurrencies to their treasury strategies must carefully evaluate the risks and opportunities. At BTG Advisory, we are well placed to guide companies across crypto due diligence, and treasury management. Contact us today to discuss how we can help you navigate this evolving market with confidence.

Daily News Round Up

Sign up to our daily news round up and get trending industry news delivered straight to your inbox

This site uses cookies to monitor site performance and provide a mode responsive and personalised experience. You must agree to our use of certain cookies. For more information on how we use and manage cookies, please read our Privacy Policy.