UK trade dynamics have been unfavourable for years. Global demand has been stifled by a long list of formidable headwinds, including Brexit, trade disputes, pandemic-induced supply chain disruptions, and macroeconomic pressures. High inflation and interest rates have compelled businesses to take on often excessive leverage, while energy costs have increased operational costs leaving less capacity for business investment. Concurrently, stringent sustainability standards have pushed UK firms to integrate ESG criteria, reshaping sourcing decisions and regulatory compliance, albeit at higher operational costs and risks for non-compliance.

These factors have exacerbated both declining productivity and labour shortages, deteriorating trading conditions for UK exporters. In response, internationally focused UK companies need cohesive corporate strategies to mitigate trade barriers, address skills gaps, leverage artificial intelligence (AI), and meet rising sustainability standards. This corporate transformation has prompted many firms to re-evaluate business models and supply chains, as well as forge new trade relationships beyond the EU. Strengthening supply chain resilience through AI-driven efficiency gains and alignment with global sustainability standards is crucial for enhancing trade resilience and competitiveness, but it is time-consuming and expensive, and strategy execution is rarely straightforward.

UK trade and GDP data

In May, UK goods imports and exports decreased by £2.3bn and £0.8bn respectively, according to newly published ONS data. This was driven by declines in trading machinery and transport equipment from the EU, linked to a decrease in exports of aircraft to Germany. Early estimates suggest imports of services increased by around £0.1bn (0.4%) in value terms in May, while exports rose by £0.1bn. The S&P Global Purchasing Managers’ Index for May reported growth in service sector activity, albeit at a slower rate than in recent months. Demand for business services improved although growth in financial services was slower. Consumer-facing services saw weaker activity and demand in May.

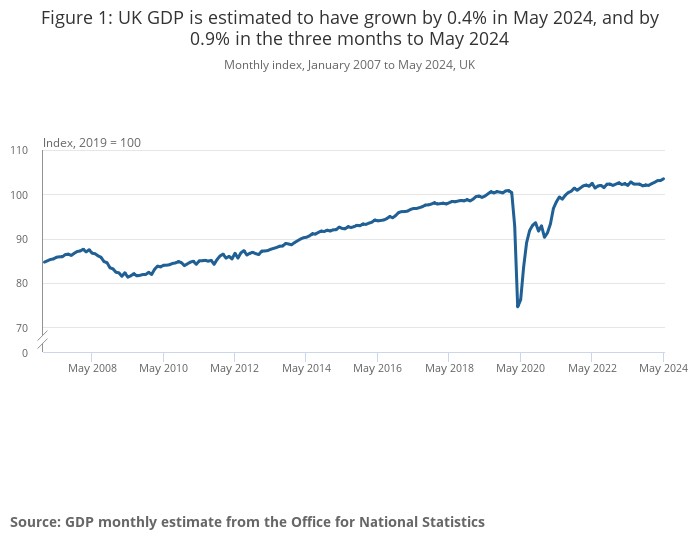

GDP estimates for May reveal a return to growth climbing 0.4% after stalling in April, ONS data shows. Growth was supported by the fastest pace in construction output (1.9%) in almost a year, as well as positive growth in services (0.3%) and production (0.2%). It follows a solid first quarter which was revised up to 0.7%. “The rise in GDP in May was the fourth increase in the past five months, which supports the idea that the dual drags on activity from higher interest rates and higher inflation are starting to fade,” wrote Ashley Webb, UK Economist at Capital Economics. The monthly GDP rise was twice the pace of the consensus forecast, setting the economy on track for a second consecutive positive quarter, but may revive inflationary risks and give the Bank of England (BOE) pause for thought over whether it finally begins interest rate cuts on Thursday 1 August, as many economists forecast. “The timing of the first cut will be heavily influenced by June’s inflation and May’s labour market data releases next week,” caveats Capital Economics’ Webb.

Never-ending Brexit impacts on UK trade

The outlook for UK trade remains mixed. Rachel Reeves, the newly-appointed Chancellor of the Exchequer, has signalled that she aims to lower EU trade barriers and revise elements of Boris Johnson’s Brexit deal. The Office for Budget Responsibility, the UK’s fiscal watchdog, estimates Brexit will reduce UK trade by 15%, while a recently published London School of Economics (LSE) analysis found the impact of Brexit on aggregate UK trade has, so far, been relatively small. However, the limited aggregate effect masks variance between firms across industries and by size, according to the LSE paper. Small firms that export goods to the EU have suffered most from the new trade costs created by the Trade and Cooperation Agreement (TCA). An estimated 20,000 small firms have stopped exporting goods to the EU entirely under the TCA. Larger firms, which account for the vast majority of trade, have adapted more easily to the new trade regime, albeit at a high cost.

As the LSE paper points out, the UK–EU relationship remains dynamic, marked by ongoing divergence in regulation and economic policies. While the EU regularly introduces new regulations, such as health and safety standards for food and consumer products, the UK’s divergence, where it does not adopt these regulations, leads to an incremental separation from the EU over time. Simultaneously, the UK actively diverges through its own independent regulations, including subsidies, social policies, and labour standards, further shaping its distinct regulatory path apart from the EU. All of which increases UK–-EU trade frictions and costs.

Reeves reportedly wants closer alignment with EU regulations, as she said in a pre-election speech pointing to the chemicals sector and improved terms for financial services. Reeves plans an early international investment summit to attract foreign investors and stimulate the UK economy while affirming no intention to rejoin the single market or customs union

Exports trade

UK exporters are optimistic about increased export turnover in the latter half of 2024, reflecting improved global market conditions and demand, according to the Allianz Trade Global Survey 2024. Nearly 87% anticipate higher turnover, with 29% expecting significant growth up to 10%. Government subsidies, including sector-specific green initiatives and support for energy cost offsets, have bolstered exporter confidence. Rising export prices are expected to boost profitability and revenue. Furthermore, UK exporters prioritise domestic investment over other European markets to boost production capacity and global competitiveness.

The top risks to export success include geopolitical tensions, protectionism, shortages of inputs and labour, and financial risks such as non-payment, according to the Allianz survey. Companies are mitigating these risks through enhanced supply chain management, rigorous ESG due diligence, and increased insurance coverage. Over half of global respondents, including UK firms, are contemplating supply chain relocation due to geopolitical risks, potentially exacerbating inflationary pressures. Roughly 40% of exporters foresee heightened non-payment risks, notably in construction, electricity, and paper sectors.

Domestic trade

Domestic business confidence and conditions slightly improved in the second quarter, albeit from a very low base. According to the latest British Chambers of Commerce survey, which captures almost 5,000 UK SMEs, 40% of business-to-business service companies (e.g. legal and finance), 37% of manufacturers and only 33% business to consumer firms (e.g. hospitality and retail) all saw a boost in domestic sales. Almost 1 in 6 firms (58%) expect turnover to increase over the next 12 months, and 51% of companies expect profits to increase next year. However, despite improved trading conditions most firms are still not increasing investment. Transport and logistics firms were outliers, with 42% of firms in these sectors reporting increased investment levels. Inflation remains the biggest external worry, followed by competition and tax. “The last four years have seen SMEs deal with one crisis after the other,” says BCC’s David Bharier. “As some of these crises have ebbed, more SMEs are regaining confidence and reporting increased sales and cash flow. However, investment levels remain a long-term concern and significant sectoral divergences remain, as sectors such as hospitality and retail continue to report far tougher trading conditions.”

Role of AI and sustainability

AI and sustainability are central to reshaping the future of global trade. AI integration offers productivity improvements by automating routine tasks and streamlining supply chain management. AI should also increase trade of goods at the heart of the AI revolution (e.g. computers, electronics and robotics), as well as cross-border services sales (e.g. data and digital services), overall reducing costs and increasing export volumes. However, the scale and timing of productivity and sales gains remain unclear, and AI adoption imposes high initial costs and regulatory complexities which will vary between different countries.

Sustainability remains a critical imperative in global trade, from reducing carbon footprints to integrating green technologies and aligning business strategies with environmental, social and governance (ESG) criteria. However, progress in emissions reduction often falls short of ambitious global targets, and the burden of sustainability transformation costs falls heaviest on smaller companies. Significant emissions still originate from legacy production processes. Addressing these challenges requires time, investment, effective policy interventions (e.g. environmental regulations, government subsidies and incentives for clean technologies), and international cooperation to harmonise climate policies.

If you would like to discuss how BTG Advisory can support your business to improve operations, optimise export sales and minimise import costs, please contact a member of our team today. We would be delighted to help.

Daily News Round Up

Sign up to our daily news round up and get trending industry news delivered straight to your inbox

This site uses cookies to monitor site performance and provide a mode responsive and personalised experience. You must agree to our use of certain cookies. For more information on how we use and manage cookies, please read our Privacy Policy.