The UK’s tourism and travel industry are set for another record-breaking year for inbound visitors, but the headline figures mask a more complex picture below the surface, despite the well publicised concerns about VAT for tourists. While international visitor numbers and spending are forecast to hit new highs, real-term spending declines, domestic travel struggles, and weak business travel demand all reveal a fragile recovery for an industry in transition. Airlines and travel operators are adapting business models to strengthen demand resilience and address shifting consumer preferences.

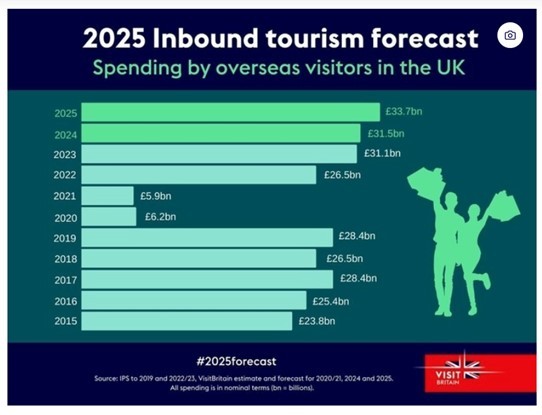

International arrivals to the UK are projected to reach 43.4 million in 2025, a 5% increase from 2024’s 41.2 million, according to VisitBritain data, marking the third consecutive record year for visitor numbers. Tourism spending is forecast to rise 7% year-on-year to £33.7 billion, up from £31.5 billion in 2024. However, on an inflation-adjusted basis, real spending remains below 2019 levels, with 2025’s forecasted expenditure equating to just 93% of pre-pandemic spending. Rising costs across the UK tourism sector and the rebound in inflationary pressures are dampening discretionary spending.

Source: Visit Britain

Long-haul markets are set to grow by 7%, led by the US, the UK’s largest and most valuable visitor market, where spending is forecast to rise to £6.7 billion in 2025, a 9% increase on 2024. Visits from Europe are also showing growth, with forecasts up 4%, but the UK risks losing market share to Western European rivals. Tourism across Western Europe is projected to grow at a faster rate than the UK’s, a trend proving difficult to reverse amid economic headwinds, rising costs, and intensifying global competition. Air France-KLM’s chief executive highlighted the “amazing” demand from wealthy American travellers, increasing demand for business and first-class seats, in a sign that high-spending holidaymakers are replacing corporate travellers.

Airlines and travel operators are adjusting to shifting patterns of demand. Tui, Europe’s largest travel operator, is reportedly increasing the number of seats it sells on other airlines’ aircrafts to expand capacity, amid constraints caused by Boeing aircraft delivery delays. Through partnerships with Ryanair and easyJet in the UK, Tui is expanding “dynamic packaging” deals, allowing consumers to select flights and hotels from a wider range of providers when booking trips. The approach mirrors the model used by online travel agencies such as Booking.com and Expedia, reflecting a shift towards greater flexibility as travellers remain cost-conscious. Tui reported modest 2% growth in packaged holiday bookings for the upcoming summer, although UK bookings were down compared to last year. Dynamically packaged holidays, where customers assemble their trip components from multiple providers, were up 18% year-on-year to 700,000 in the three months to December, underlining the strengthening consumer demand for choice. Increased consumer flexibility aims to offset potential weakening demand. This low-growth expansion model also allows travel operators to continue growing without the high costs of traditional capacity expansion.

Not all travel businesses are managing to adapt. At the opposite end of the market, smaller travel operators are struggling. Jetline Travel, owner of Jetline Holidays and Jetline Cruise, ceased trading on 6 March, the Civil Aviation Authority (CAA) confirmed. The UK travel agency allegedly breached contracts that affected bookings with third parties, including Princess Cruises, Cunard, and Holland America Line, resulting in cancellations. Separately, all P&O Cruises bookings were retained and transferred to direct bookings.

Domestic and business travel still lagging

While inbound tourism momentum is strong, the outlook for domestic tourism and business travel is more sluggish. VisitBritain’s February Domestic Sentiment Tracker indicates that UK tourists remain cautious, with 51% believing that “the worst is still to come” amid concerns over inflation’s resurgence. Rising costs are dampening domestic travel demand, with 44% of respondents citing expensive accommodation and 33% pointing to the rising cost of eating out as barriers to taking short UK breaks in the next six months.

Sentiment correctly identifies a troubling macro context for the UK economy, which will percolate through to UK household holiday budgets, for both domestic and overseas travel. UK CPI inflation spiked to a 10-month high of 3% in January, in part due to higher seasonal airfares and increased costs for food and non-alcoholic drinks, ONS data shows. The Bank of England (BoE) forecasts inflation will spike to 3.7% later in 2025, while the economy’s projected annual growth rate is expected to halve to 0.75% in 2025, down from an earlier estimate of 1.5%. The BoE cut interest rates to 4.5% in February, the lowest level since June 2033, but further cuts are currently expected to be gradual, offering limited monetary policy relief for the travel and tourism sector, but could easily not be implemented if inflation remains high.

Annual business visits remain down by around 1.5 million compared to pre-pandemic levels, reflecting an ongoing shift away from routine corporate travel. While demand for ‘meetings, incentives, conferences, and exhibitions’ (MICE) travel has proven more resilient, it has yet to return to pre-pandemic strength, with remote work and virtual meetings permanently reshaping corporate travel patterns.

British Airways owner International Airlines Group has warned that business travel may never return to pre-pandemic levels, particularly for short-haul corporate trips, requiring airlines to fill premium seats with high-spending leisure passengers instead. Alongside the shift towards digital meetings, strengthened corporate sustainability policies are also contributing to a long-term decline in business air travel demand.

Conclusion

Despite record-breaking inbound tourism, UK travel and tourism businesses face significant financial pressures. Rising inbound visitor numbers will not necessarily translate into stronger profitability for UK travel and tourism-related businesses, as inflation-adjusted spending lags, domestic demand remains subdued, and structural changes in spending patterns weigh on the sector.

For travel operators, airlines and related service providers, the financial trade-offs remain difficult to balance. Rising operating costs – labour, fuel, marketing, and digitalisation investment – are challenging revenue growth, putting sustained pressure on margins. The demand outlook is also subject to external macro and geopolitical risks, which can change expectations quickly.

Companies may benefit from stress-test cash flow forecasts across multiple demand scenarios and should remain alert to cost pressures in an uncertain inflationary and macroeconomic environment. BTG Advisory is well-placed to support travel and hospitality businesses in this capacity. Our team of sector specialists can conduct independent business reviews, corporate restructuring, and help secure new equity and debt capital. If your business would benefit a confidential assessment, do not hesitate to contact our team today.

Daily News Round Up

Sign up to our daily news round up and get trending industry news delivered straight to your inbox

This site uses cookies to monitor site performance and provide a mode responsive and personalised experience. You must agree to our use of certain cookies. For more information on how we use and manage cookies, please read our Privacy Policy.