The UK construction sector is grappling with persistent headwinds. Growth in construction business activity has softened to the slowest pace since June 2024, according to the S&P Global UK Construction PMI. Headline construction PMI fell to a six-month low of 53.3 in December. Declining housebuilding, coupled with subdued demand conditions, persistently high interest rates, and fragile consumer confidence, have significantly impacted activity levels. Decreased levels of new construction starts were reported in 2024 outside London, as the construction sector remains less willing to take on risk amid the present economic and geopolitical backdrop.

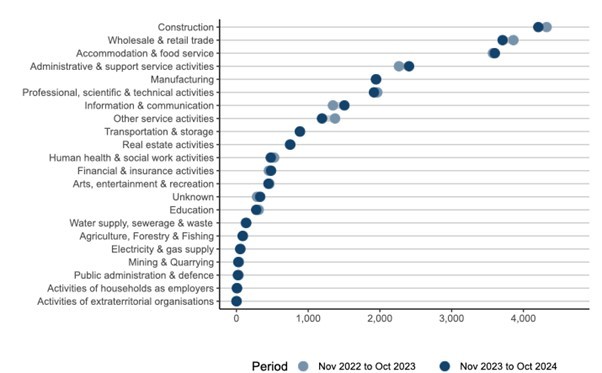

Firms and contractors are concerned that the deteriorating UK economic outlook, rising labour costs from last autumn’s Budget, and geopolitical and currency volatility will weigh on investment into 2025. Adding to these pressures, supply chain disruptions and rising material and labour costs have contributed to a surge in insolvencies. In the 12 months to October 2024, 4,208 construction companies in England and Wales entered insolvency, according to the Insolvency Service. This figure represents 17% of total insolvencies by industry and marks a 31% increase compared to 2019 pre-pandemic levels when 3,217 companies went under.

Chart 1: Number of insolvencies across different sectors

Source: The Insolvency Service

Challenges driving distress

The surge in insolvencies across the UK construction sector highlights a fragile and fragmented industry struggling under multiple, interrelated pressures. Chief among these challenges are cash flow problems caused by late payments and bad debts, which continue to strain smaller firms operating on thin margins. Many contractors have been unable to recover from the dual burdens of higher borrowing costs and fixed-price contracts, which expose firms to mounting losses as inflation drives up material and labour expenses.

Supply chain disruptions, compounded by global uncertainties, have further exacerbated operational difficulties, resulting in delays and surging costs. At the same time, intense competition has forced firms to adopt low-margin bids to secure contracts, often at the expense of profitability. Skilled labour shortages – a longstanding issue – have not only reduced productivity but have also increased wage pressures, further squeezing already stretched budgets. Additionally, regulatory compliance costs have disproportionately impacted smaller firms, which often lack the financial resilience to absorb these additional expenses.

Within the UK construction sector, certain sub-sectors are particularly susceptible to financial distress. Specialised construction activities such as demolition, site preparation, electrical and plumbing installation, and finishing trades like plastering and glazing are consistently among the most affected, Insolvency Service data shows. These companies typically operate on a subcontract basis. The systemic challenges of low margins, variable costs, and the inherent unpredictability of the construction process continue to pose a risk to firms, according to the Building Cost Information Service (BCIS).

Rising cost inflation and salary payments have also held back staff hiring, with job creation levels failing to recover to pre-pandemic norms. According to S&P Global, subcontractor rates increased at the fastest pace in 20 months, compounding the upward pressure on input costs. Many firms remain burdened by loss-making contracts and liquidity issues, with some attempting to overtrade in an effort to survive. However, such strategies often risk further financial instability and ripple effects across the broader sector.

Fallout from major collapses: the ISG example

The fragility of the sector is epitomised by the collapse of ISG Ltd in September 2024, marking the largest construction firm failure since Carillion in 2018. The fallout from ISG’s collapse triggered a domino effect among its suppliers. In October 2024, Seventynine Lighting, a Gloucestershire-based lighting subcontractor, entered administration due to “insurmountable” bad debt of around £2 million, resulting in 30 staff redundancies. The following month, Vitrine Systems, a glazing specialist, also went into administration, citing a £187,000 debt owed by ISG. This insolvency led to 23 job losses. The cascading impact of ISG’s failure underscores the fragility of the construction supply chain, as smaller firms often lack the resilience to absorb unpaid debts from major contractors.

Reasons for optimism

Despite the challenges, there are signs of resilience and recovery. The gradual stabilisation of inflation and interest rates has started to offer relief, with 48% of the S&P Global survey panel predicting output growth in 2025, even though 15% still anticipate a decline. Such optimism suggests a cautious improvement in market conditions as cost pressures ease.

The UK government’s commitments to infrastructure and housing remain a critical source of optimism. It has pledged to build 1.5 million homes over the next five years and a £775 billion infrastructure pipeline spanning energy, digital, and transport projects. These initiatives aim to modernise infrastructure and stimulate economic growth, creating long-term construction sector opportunities.

Reforms to the National Planning Policy Framework (NPPF) further highlight potential catalysts for growth. These revisions focus on unlocking lower-quality land, often referred to as the ‘grey-belt,’ and streamlining processes for nationally significant infrastructure projects (NSIPs). Changes to compulsory purchase rules and the modernisation of local planning authorities aim to enhance efficiency and accelerate development timelines.

Strategic investments are also providing momentum. A standout example is Blackstone’s £10 billion investment to build an AI data centre in Blyth, Northumberland, which will create 4,000 predominantly construction-related jobs. This project reflects the growing relevance of data centres for the sector and underscores the government’s commitment to fast-tracking planning approvals for high-value developments.

Conclusion

In 2025, the UK construction sector will remain under pressure from insolvency risk, supply chain fragility, and macroeconomic and geopolitical uncertainty. However, firms that are able to stabilise costs, optimise working capital and enhance operational efficiencies through technological advancements will be well placed to succeed. Navigating these challenges will require prudent balance sheet management, strategic business model positioning, and adaptability to evolving market conditions. If your company would like a confidential discussion with our team about the challenges your firm faces, do not hesitate to get in touch today.

Daily News Round Up

Sign up to our daily news round up and get trending industry news delivered straight to your inbox

This site uses cookies to monitor site performance and provide a mode responsive and personalised experience. You must agree to our use of certain cookies. For more information on how we use and manage cookies, please read our Privacy Policy.