Some lenders will have a reduced appetite and capacity to lend to smaller businesses due to higher regulatory costs which reduce loan profitability, they often need help with exit management. Rationalising loan book exposures can involve ending long-term borrower relationships, including both performing and non-performing borrowers. Furthermore, while historically most of this work comes from banks, alternative lenders are also starting to selectively rationalise loan books.

When a lender wants to end a borrower relationship - whether at maturity, during the life of a facility or because a borrower behaviour or specific events (such as asset sales) have driven it - it can create challenges that require expert intermediation from the lender’s adviser. In most cases, while the lender seeks a swift loan exposure reduction, the impact on the borrower can lead to disruption in its operations, potential loss of contracts and sales and potentially higher loan costs from a new funding provider.

In this regard, BTG Advisory’s Lender Advisory team can help. When mandated, our team manage the entire process to either work with both lender and borrower to construct a repayment plan or refinance the incumbent loan via a new funder. Regardless, BTG Advisory will ensure the highest levels of transparency and the best possible mutual outcome for both parties. There are no one-size-fits-all solutions. Sometimes a simple six-month extension on a maturing loan is sufficient, whereas other long-dated maturities may require a loan sale to resolve swiftly.

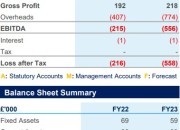

We conduct thorough due diligence to understand the borrower’s business, historical and forecast financial performance, prospects/challenges, and assess their debt capacity, security, and potential structure financing options. This information will be distilled into an Information Memorandum to provide sufficient detail to potential lenders/loan buyers to facilitate a swift refinancing or loan sale. By facilitating a quick, transparent, and informed process, we unlock potential exits for the lender to create mutually beneficial outcomes.

More specifically for borrowers, we help mitigate the disruptive impacts of a lost lender relationship, working to ensure all relevant financial information meets lender requirements (including sustainability metrics and additional compliance reporting) to maximise a successful outcome.

If it looks like there may not be a viable refinance option, BTG Advisory is well placed to run an equity process instead, or in parallel to the refinancing process. This can help source new owners or investors for the business to help facilitate repayment of the existing financing arrangements. We are increasingly seeing borrowers, in a high interest rate environment, being prepared to accept some equity dilution to de-risk/de-leverage the business.

Deal Success

The detailed review undertaken by BTG Advisory supported a positive recommendation to enable the business to refinance with the lender

How we helped:

A detailed and thorough review undertaken by BTG Advisory concluded with a positive outcome for the bank and business

How we helped:

The outcome of this portfolio recovery assignment yielded excellent results for the bank, providing an outstanding value added service

How we helped:

BTG Advisory’s extensive knowledge of the healthcare sector helped highlight issues facing the provider and provide the most appropriate recommendation to help stabilise the business

How we helped:

The team undertook a detailed analysis of the school which facilitated a successful strategy to be put in place to ensure a satisfactory return for the lender

How we helped:

Daily News Round Up

Sign up to our daily news round up and get trending industry news delivered straight to your inbox

This site uses cookies to monitor site performance and provide a mode responsive and personalised experience. You must agree to our use of certain cookies. For more information on how we use and manage cookies, please read our Privacy Policy.